Trend reversals are situations where meaningful turning points take over the price action in the market structure. They cause a prevailing trending price to slow down and consequently make a contrary move that, when decisive enough, leads the market to reverse that established price direction.

What are those turning points? An uptrend or downtrend eventually finds the following areas:

- Supply when there is an uptrend (Key Level of resistance)

- Demand when is downtrend (k level of support)

Trend Reversals Are Not Pullbacks

As the trend evolves towards a turning point, it is “discovering” those areas. Each discovery is a pullback, essentially a first try, then a second try, etc., to reverse the market.

They fail to reverse since there is not enough conviction in those discovering areas until the trend effectively reaches a price area where the market begins to foresee a reversal as the demand or supply overcome each other, depending on whether it is an uptrend or a downtrend.

- In a bullish trend, the buyers who pushed the price higher start selling their position, incentivizing the bearish side.

- In a bearish trend, sellers influence the demand by closing their positions on the buying side.

Identifying Trend Reversals

Understanding what a pullback is and how it differs from a trend reversal is fundamental to identifying a meaningful turning point in a trend. When the price reaches those turning areas, as supply and demand scrabble, the price action starts showing signals of weakness.

For example:

- Candle formations and patterns such as head and shoulders, morning stars (bullish), shooting stars (bearish), and double tops and bottoms appear.

- Trendlines face breakouts.

- Indicators show signals.

It is vital to note that the formations, breakouts, and signals arise as the price moves sideways. Generally, a trend reversal needs time to start a counter-move.

Check out also: Mastering RSI: Advanced Techniques for Reversals and Trend Confirmation!

Which Indicators to Use in Crypto?

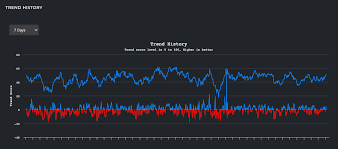

As the trend weaknesses and shows signs of a likely reversal, an indicator acts as a confirmation tool. Let’s briefly point out some of the most used and how to use them.

RSI Divergence:

This type of divergence typically spots more pullbacks than reversals.

However, when combined with double tops/bottoms, which is where it essentially occurs, RSI divergence spots better likely reversals.

Identifying an RSI divergence over a supply or demand area is a receipt for a potential trend reversal.

Golden Cross vs. Death Cross

Moving average crossovers within periods such as 50 and 100 adds weight to identifying trend reversals. Golden and death crosses occur precisely employing these periods and are reliable methods, especially in higher time frames.

- Bullish when 50 goes above 100.

- Bearish when 50 goes below.

MACD Divergence and Crossovers

MACD divergence is one of the most powerful. Typically, it appears as three uncorrelated moving average waves with the price highs (bull-side) or lows (bear-side) followed by a crossover within them.

This type of divergence plots highly accurate signals.

Conclusion

Trend reversals occur when a prevailing trend weakens. In the middle, there are only failed trials that end in pullbacks. Indicators in confluence with k levels and patterns are the ultimate signal to identifying and seizing trend reversals.